Makaleler

37

Tümü (37)

SCI-E, SSCI, AHCI (3)

SCI-E, SSCI, AHCI, ESCI (8)

ESCI (5)

Scopus (14)

TRDizin (14)

Diğer Yayınlar (10)

1. Antecedents of e-money adoption intention among Indonesian and Turkish consumer

Management Science Letters

, ss.609-616, 2020 (Scopus)

5. The Level of Tax Complexity: A Comparative Analysis Between the UK and Turkey Based on the OTS Index

International Tax Journal

, cilt.18, sa.1, ss.28-40, 2018 (Hakemli Dergi)

10. International Experiences of Tax Simplification: Distinguishing Between Necessary and Unnecessary Complexity

EJOURNAL OF TAX RESEARCH

, cilt.14, sa.2, ss.337-358, 2016 (Scopus)

14. Limited Şirket Ortaklarının Kamu Alacağına İlişkin Sorumluluklarının Değerlendirilmesi

İnonu Universitesi Hukuk Fakültesi Dergisi

, cilt.4, sa.2, ss.75-104, 2013 (TRDizin)

15. Bölgesel Kalkınma Ajanslarının Denetiminde Sayıştay’ın Rolünün Değerlendirilmesi

SDÜ İktisadi ve İdari Bilimler Fakültesi Dergisi

, cilt.18, sa.2, ss.65-84, 2013 (Hakemli Dergi)

16. Bakanlar Kurulunun Vergi Oranını Belirleme Yetkisinin Alt Sınırı Sıfır Oran ın Anlamı

Çukurova Üniversitesi Sosyal Bilimler Enstitüsü Dergisi

, cilt.22, sa.1, ss.399-426, 2013 (TRDizin)

18. Tax Professionals Perceptions of Tax Fairness Survey Evidence in Turkey

International Journal of Business and Social Science

, cilt.3, sa.2, ss.112-117, 2012 (Hakemli Dergi)

20. Kamu Alacağı: Hukuki Bir Değerlendirme

BUSINESS AND ECONOMICS RESEARCH JOURNAL

, cilt.2, sa.2, ss.61-76, 2011 (TRDizin)

22. The Basis For Taxation In Turkey: Public Interest

International Research Journal of Finance and Economics

, sa.64, ss.170-185, 2011 (Hakemli Dergi)

23. Kamu İhale Sürecinde Gizlilik İlkesi: Yaklaşık Maliyet Bedeline Yönelik Uygulama (!)

VERGİ DÜNYASI DERGİSİ

, sa.354, ss.143-148, 2011 (TRDizin)

25. Tarifsiz Tarife: GVK Md.103

Yaklaşım Dergisi

, sa.214, ss.184-190, 2010 (Hakemli Dergi)

26. Anayasal Vergileme İlkeleri Sporcu Ücretlerinin Vergilendirilmesi

Vergi Dünyası Dergisi

, sa.346, ss.114-125, 2010 (TRDizin)

27. Müzayede Yoluyla Satılan Sanat Eserlerinin Vergilendirilmesi

Maliye Dergisi

, sa.159, ss.167-182, 2010 (SCI-Expanded, Scopus, TRDizin)

28. Kültür ve Eğitim Amacı Taşıyan Katma Değer Vergisi İstisnası: Vakıf Üniversiteleri

ANKARA ÜNİVERSİTESİ HUKUK FAKÜLTESİ DERGİSİ

, cilt.59, sa.3, ss.449-465, 2010 (TRDizin)

29. Vergilendirme Yetkisinin Sınırlandırılması

Çukurova Üniversitesi Sosyal Bilimler Enstitüsü Dergisi

, cilt.16, sa.1, ss.133-144, 2007 (TRDizin)

30. Vergi Mahkemesi Kararları Nasıl Okunur

Kazancı Hukuk Dergisi

, ss.143-153, 2007 (Hakemli Dergi)

31. Türk Vergi Hukukunda Vergi Adaleti: Anayasal Vergilendirme İlkeler

VERGİ DÜNYASI DERGİSİ

, sa.308, ss.205-221, 2007 (TRDizin)

32. Teoride ve Uygulamada En Az Geçim İndirimi

VERGİ SORUNLARI DERGİSİ

, cilt.30, sa.222, ss.106-122, 2007 (TRDizin)

33. Kurumlar Vergisinde Entegrasyon: 5479 ve 5520 Sayılı Yasa İle Nereden Nereye

VERGİ SORUNLARI DERGİSİ

, cilt.29, sa.217, ss.158-172, 2006 (TRDizin)

34. Yabancı Yatırımcıya Yönelik Stopaj İndirimi Eşitliğe Aykırıdır

LEGAL MALİ HUKUK DERGİSİ

, cilt.2, sa.21, ss.2209-2215, 2006 (TRDizin)

36. Latin Amerika’da Bazı Vergilendirme İlkeleri: Avrupa ve ABD Deneyimlerinden Dersler

VERGİ SORUNLARI DERGİSİ

, sa.200, ss.167-185, 2005 (TRDizin)

37. Meslek Mensuplarında Mesleki Sorumluluk Sigortası

E-Yaklaşım Dergisi

, sa.149, ss.616-640, 2005 (Hakemli Dergi)

Hakemli Bilimsel Toplantılarda Yayımlanmış Bildiriler

34

18. Opportunities for Graduate Education and International Cooperation in the Field of Public Finance

32. International Public Finance Conference, Antalya, Türkiye, 10 - 14 Mayıs 2017, (Tam Metin Bildiri)

28. Attitudes toward Bribery in Turkic Republics A Comparative Study

Masters International Research and Development Center (MIRDEC), Social Science Conference, PRAG, 19 - 21 Temmuz 2016, (Özet Bildiri)

33. Limits of Interference in Freedom of Employment: Taxation

International Conference, "Education, Science, Economics and Technologiesin the Global World, Bourgas, Bulgaristan, 14 - 16 Eylül 2007, ss.110-125, (Tam Metin Bildiri)

Kitaplar

12

10. Türk Vergi Hukukunda Kişiliğin Sona Ermesi ve Sonuçları Gerçek Kişiler

XII Levha Yayınları, Bursa, 2011

11. Türk Vergi Hukukunda Anayasal Ölçüt Mali Güç

XII Levha, Bursa, 2010

12. Türk Vergi Hukukunda İhbar ve İhbar İkramiyesi

Maliye Araştırma Merkezi Konferansları Prof. Dr. Şerafettin AKSOY’a Armağan, yok, Editör, Gür Ay, İstanbul, ss.41-60, 2010

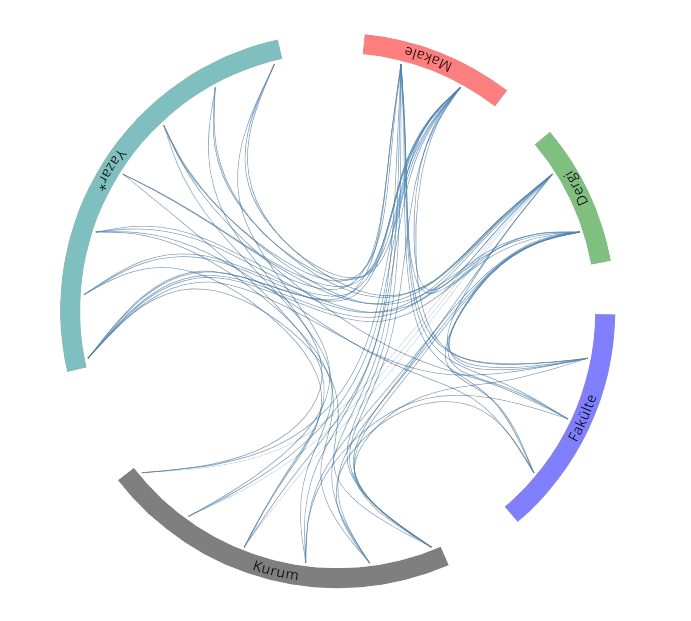

Yayın Ağı

Yayın Ağı